contact@acs-consulytics.in

Implementing a robust fraud detection system enhances operational efficiency, improves

customer trust, and minimizes financial losses.

Fraudulent claims cost the insurance industry billions annually, impacting profitability and leading to higher premiums for policyholders. Implementing a robust fraud detection system enhances operational efficiency, improves customer trust, and minimizes financial losses.

ACS-Consultyics specializes in leveraging advanced analytics and machine learning techniques to identify, prevent, and manage fraudulent activities in insurance claims.

Insurance companies face the following challenges:

- Identifying fraud in large volumes of claims data for auto, dental, massage, eye or any general insurance claims.

- High operational costs due to manual fraud investigation processes.

- Reputational risks associated with undetected fraudulent activities.

- False positives that lead to delayed claim settlements for genuine customers.

To develop a fraud detection system that accurately identifies potentially fraudulent claims using data analytics and machine learning, minimizing false positives and enhancing claim processing efficiency.

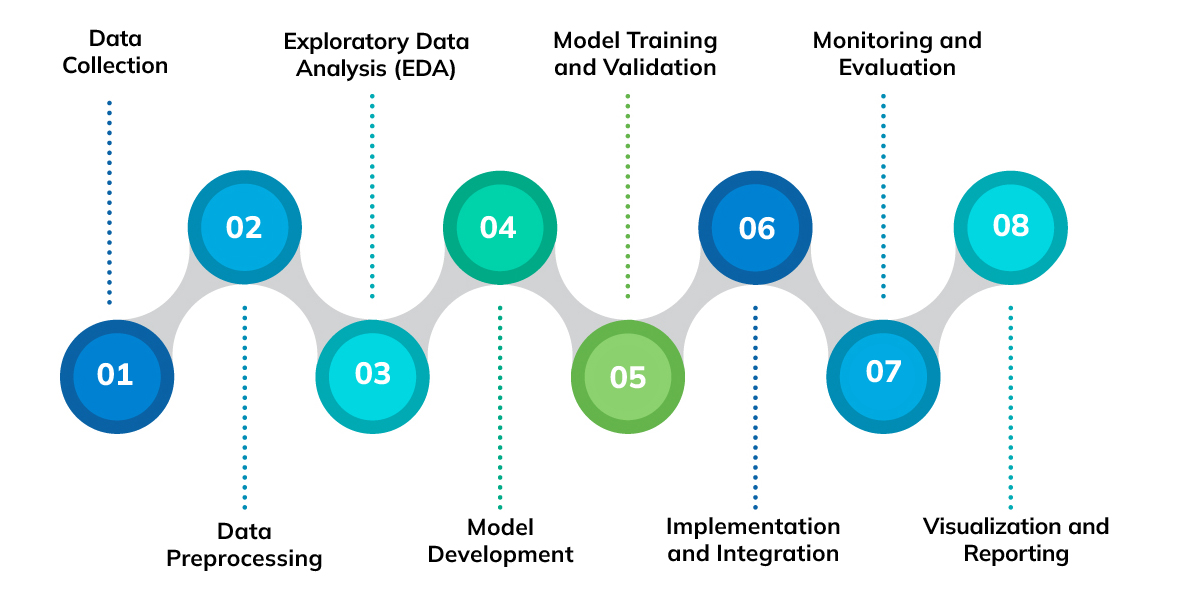

- Aggregate historical claims data, policyholder information, and third-party data sources (e.g., public records and digital footprints for claimants).

- Compile datasets containing labeled examples of known fraudulent and genuine claims for supervised learning models.

- Clean and standardize the data for consistency.

- Address missing or erroneous values using imputation techniques.

- Engineer features such as claim frequency, claim amount, and geographic patterns.

- Investigate trends and anomalies using visualization tools to uncover suspicious patterns (e.g., abnormal spikes in specific regions or claim types).

Analyze correlations between variables to identify potential fraud indicators.

- Utilize machine learning algorithms like Random Forest, Gradient Boosting, and Neural Networks for fraud classification.

- Apply anomaly detection methods for unsupervised learning scenarios.

- Leverage a hybrid model combining supervised and unsupervised methods for higher precision.

- Train models on historical datasets while balancing fraudulent and genuine claims.

- Validate using cross-validation and refine performance through hyperparameter optimization.

- Embed the model into the claims management workflow.

- Integrate seamlessly with existing systems to facilitate real-time fraud detection.

- Regularly assess model performance using metrics such as precision, recall, and F1-score.

- Update models with new data to adapt to evolving fraud patterns.

- Deliver user-friendly dashboards to visualize flagged claims and trends.

- Offer detailed insights to prioritize investigations for fraud detection teams.

Subscribe to our newsletter

Copyright © 2025 ACS-Consultyics | All Right Reserved